UPDATES

APRIL 5, 17.51: In a statement justifying its policy, Anchor Retirement refers to the Office of Fair Trading report which stated that “terms in long leases preventing sub-letting have potential for unfairness” and that “permission [to sub-let] should not be unreasonably withheld”. See below

APRIL 5 It emerges that another Anchor Retirement site is in ferment over this issue, Hyett Orchard in Painswick, Gloucestershire. If there are others, please get in touch with Campaign against retirement leasehold exploitation. Campaign against retirement leasehold exploitation is deeply sceptical about Anchor’s motives in introducing this policy. How can it not leave Anchor and those who sub-let these properties – in defiance of the lease – liable to civil damages if any leaseholder suffers harm as a result of this policy? Campaign against retirement leasehold exploitation advises those opposed to this policy to take proper legal proceedings at the LVT to enforce the lease. This is beyond the scope of the Housing Ombudsman (whose decision Anchor could ignore). See below

A second Anchor Retirement leasehold site has declared itself strongly against allowing sub-letting, which is specifically prohibited in the lease.

Today a packed meeting at Woodville Grove (above), at Welling in Kent – on the outskirts of London – told Anchor executives of their furious opposition to the proposal

“There were bums on seats that have never been on seats at other meetings before,” said resident Barbara Little, 63, who is leading the opposition to Anchor’s new policy.

Little estimates that 52 residents in the 63-flat site attended to hear Abigail Poole, of Anchor Retirement’s leasehold department, explaining the housing association’s change of heart.

Little is furious that Anchor Retirement is allowing sub-letting and – far more importantly – unilaterally ignoring the lease.

“We bought these properties on the clear understanding in the lease that sub-letting would not be allowed, and they are blatantly ignoring this.

“But if they can ride roughshod over this, what else will they do? The lease has to be a legal document or it is absolutely worthless.

“When I did some alterations work in my flat I had to pay Anchor £60 because this was a condition of the lease. Why should I pay this if we are just making things up as we go along?”

“When I did some alterations work in my flat I had to pay Anchor £60 because this was a condition of the lease. Why should I pay this if we are just making things up as we go along?”

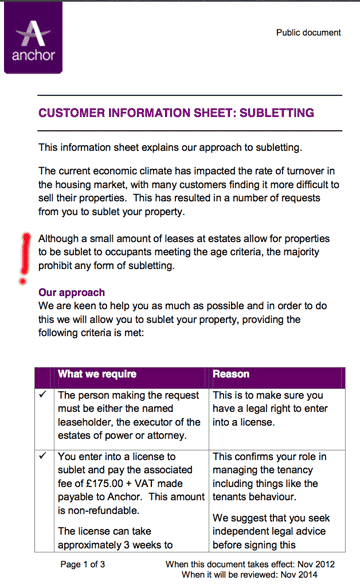

Abigail Poole told the residents that the policy meant “relaxing the rules on that clause of the lease”. But Anchor’s own leaflet to its residents makes it clear this this is a far more major step.

“Although a small amount of leases at estates allow for properties to be sublet to occupants meeting the age criteria, the majority prohibit any form of sub-letting,” it says.

Poole told the Woodville Grove residents that Anchor had been deluged by requests to relax sub-letting restrictions by leaseholders or their heirs who were unable to sell. On further questioning it appeared that nine out of 9,000 Anchor residents had actually requested this.

In December residents at grade II listed Bicester House in Oxfordshire also overwhelmingly rejected Anchor Retirement’s change of policy. The issue is now to be adjudicated by the Housing Ombudsman.

Bicester House, where the majority of residents do not wish to allow any sub-letting of the 44 properties

“I have asked them to investigate the fact that despite all Anchor’s assurances that a consultation process would take place, it hasn’t and has ignored their own policies,” said Stuart Barsby, a former senior police officer and chairman of the Bicester House residents’ association. Here 37 residents voted against Anchor’s policy and only four were in favour.

At the Hyett Orchard site in Painswick, Gloucestershire, 85 per cent of residents are opposed to sub-letting, according to Roger Teague. In October 2011, district manager Sue Clark assured the residents that no property would be sub-let, but the policy is going ahead.

As with Bicester House, the residents are going through the Anchor redress scheme which concludes with the matter being considered – in a non-disclosed and non-binding ruling – by the Housing Ombudsman.

“Anchor’s actions have destroyed the ethos of this estate and has caused needless unpleasantness and disharmony,” said Teague.

Anchor Trust is allowing leaseholders, or their executors, to rent the properties in exchange for a fee of £175 plus VAT. This is more than double the £85 sub-letting fee at retirement developments agreed between the Tchenguiz Family Trust and the Office of Fair Trading, while the Land Tribunal has ruled that £40 plus VAT is reasonable in the non-retirement sector.

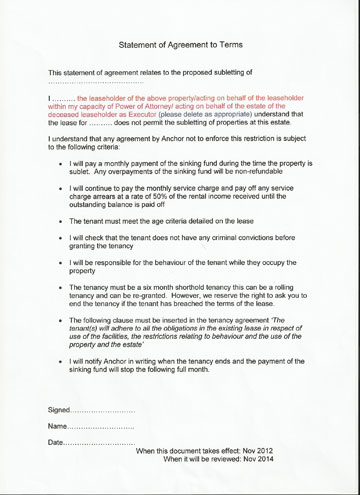

Anyone sub-letting their apartment is to sign a form (left) from Anchor Retirement – which appears to have been drafted six months ago – stating that they understand that sub-letting is not permitted in the lease. The legal liability involved in such a document – for both the leaseholder or heir intending to sub-let and for Anchor – is an open question.

Anyone sub-letting their apartment is to sign a form (left) from Anchor Retirement – which appears to have been drafted six months ago – stating that they understand that sub-letting is not permitted in the lease. The legal liability involved in such a document – for both the leaseholder or heir intending to sub-let and for Anchor – is an open question.

Campaign against retirement leasehold exploitation has no issue with residents and freehold owners at individual sites agreeing to allow sub-letting. It emerged at a recent meeting between Campaign against retirement leasehold exploitation and Age UK that this has been requested by leaseholders and is a symptom of the malaise in the retirement leasehold market.

The enthusiasm with which Anchor is intent on changing these private leases unilaterally does give rise to understandable suspicions: would the housing association really risk court action over this purely to assist leaseholders who cannot sell up? Or does Anchor have in mind tenants for these unsold retirement leasehold flats?

Campaign against retirement leasehold exploitation has been critical of Anchor Trust, whose previous chief executive John Belcher was on the widely-ridiculed salary of £391,000 per annum (the highest for a housing association chief executive). The current chief executive is Jane Ashcroft is still the best paid housing association CEO, and Anchor is the largest “not-for-profit” housing association.

The Mail on Sunday reported in February 2011 that Anchor Trust sought to obtain additional revenue by keeping the interest of investing perhaps £10 million of leaseholder contingency funds. They spent £5,000 for a legal opinion on whether it would be legal to do so. The answer was “no”.

Exit fees at Anchor sites, which go into the contingency funds, are high. Little will pay 0.9 per cent of the price paid for her flat for every year that she lives there.

Anchor statement.

Anchor statement:

An Anchor spokesman said: “Where it’s reasonable to grant consent, we will do so. Any decision made takes into account the extent of reasonable local opposition from fellow leaseholders. In all cases where consent is sought, we have a strict procedure in place to ensure that the property is only let to a suitable sub-tenant. Each case is considered on its merits.

“The £175 sub-letting fee we charge covers the cost of vetting the prospective sub-tenant, preparing the licence to sub-let and approving the sub-tenancy agreement.

“We do get requests from residents to sublet and the OFT, which has endorsed the principle that leaseholders should be able to sublet their property, said the following:

“In relation to sub-letting, we still take the view that terms in long leases preventing sub-letting have potential for unfairness under the Unfair Terms in Consumer Contract Regulations (UTCCRs). In our view a consumer should be able to seek permission to assign (by means of a sublet) and that permission should not be unreasonably withheld.

“We would see this as being particularly important in relation to leases in retirement properties. In some instances tenants may need to move out due to health issues (often to a nursing home), so subletting the property is an important means to pay service charges, and otherwise maintain the tenant’s investment in the property. Further, where the original tenant has died, often their heirs or estate will remain liable to pay service charges, while being ineligible to reside in the property themselves because of minimum age restrictions. In such circumstances, subletting may be the only means by which the property can provide any economic benefit to the owner. Further in circumstances where the market value of the property has fallen since the tenant purchased it, being obliged to sell rather than sublet is likely to cause significant hardship to the tenant.”

“We strongly refute the suggestion that granting consent to sublet would result in large scale awards for damages for breach of lease. As the OFT has suggested, provisions in leases which restrict the ability to sublet are likely to be unlawful under the Unfair Terms In Consumer Contracts Regulations.”

There is no doubt that Anchor has handled this very badly. Like many large organisations, they make their mind up first and then make a token effort to consult. At £175.00 plus VAT for consent this could be seen as just a money making exercise.

But hold on; let us look at this from another aspect. What about the relative who is desperate to sell the flat, but is not able to due to the depressed state of the market? Not only do they have a continuing liability for the service charge, but each month that goes by means they have to pay an extra percentage into the reserve fund (known as the deferred service charge). And at the same time the re-sale value of the flat declines. You have reported the plight of such people on other postings on your web site. Your posting on 8th March gave a sympathetic report on one such person. This problem may become more acute when councils levy double community charge on empty properties.

The ability to rent out flats is a solution to this problem and on McCarthy & Stone developments, where sub letting is allowed, many relatives have taken up this option. Contrary to what some people may think, tenants in leasehold retirement housing are not generally a “problem” and integrate well into the community.

Anchor could have handled this better. They could have written to leaseholders and explained why they would like to introduce this new policy, explaining the pros and cons and giving leaseholders the chance to reflect on the facts. Instead their ham fisted approach has raised the hackles of leaseholders and, regrettably, has brought out their worst prejudices. Although not stated directly, there is the implied message in many of the leaseholders’ comments that tenants will “lower the tone” of the development or, god forbid, lower property prices. (Personally I take the view that numerous empty flats on a development have a far greater impact on property prices). You reinforce this anti tenant stereotyping by your comment “Or does Anchor have in mind tenants for these unsold retirement leasehold flats?”

Anchor’s leaseholders have every right to be upset, but they or their relatives may one day find themselves having to sell their flat with no takers and a depressed market. It may lead them to a quite different view on subletting!

Campaign against retirement leasehold exploitation’s concern here is that Anchor has imposed this policy in defiance of the lease: the contract which is the only property a leaseholder has. It is this which is rightly concerning residents.

Sub-letting is often good. Far better than empty flats in run-down blocks. Indeed, Campaign against retirement leasehold exploitation advises people to rent retirement flats not buy them, as they are such appalling capital investments.

We do not want to encourage “anti-tenant stereotyping”, but we do want to know why Anchor has decided to impose this policy and are sceptical that it is in order to assist leaseholders who have difficulty selling.

Ignoring the lease in this fashion is very serious.

I agree that by imposing this policy Anchor has alienated their leaseholders. Had they taken the time to explain things fully and put forward some of the points I made in my previous comment they may have had a different reaction. With reasoned argument, I suspect many of Anchor’s leaseholders would accept renting as a “necessary evil” when times are bad, but what they don’t like is not being consulted and having things imposed on them. Anchor had the opportunity here to make an change to help ALL leaseholders, but they blew it.

I totally support Campaign against retirement leasehold exploitation here. If no sub letting is in the lease – then NO sub letting.

When purchasers bought the property(sorry, the Lease!!) they should have realised the implications, if any, of no subletting.

I bought mine because it is NO sub letting. Thats what we wanted and I did think of possible consequences.

In my opinion the main reason for a drop in sales and value of these type of property is purely due to more and more people becoming aware of what a burden they become due to horrendous managing agents against ever increasing serv scarges and ins scams etc etc. Sort that out Mr government and we will be on our way up again.

In my own situation we are all Freeholders (just 18 Apartments) so more lucky than most. We each own an 18th share in our company. What I would like to say is that, , we have recently sought legal guidance on a number of items.

One question was, just as an exercise, can we change the lease to allow letting (We do not want to). The legal answer given to us was that it could only be changed if it was a 100% vote (every apartment) to agree the change.

With the above in mind how can Anchor change the lease. Surely it has to be a 100% “yes” vote from the current leaseholders.

Whatever the decision it does not have to be set in stone. We will probably have another vote in 2 years time. If we get a 100% vote to sub let we will introduce it.

At the moment it is about the same as it has been for the last 12 years. 16 against and 2 for sub letting

Anchor is not changing the lease, but is deliberately ignoring the terms of the lease by allowing subletting. As stated in the original post, they leave themselves open to challenge either through the LVT or court if a leaseholder can prove they are disadvantaged by the subletting. And if this did go to an LVT or court what “loss” would a leaseholder prove? Reduction in the value of their flat – hard to prove. Reduction in amenity value – a bit vague. I think it would be very hard to show there had been any material loss to leaseholders. The only other option it seems to me is an injunction to stop Anchor – very expensive.

Anchor know full well that it would be a very brave leaseholder or group of leaseholders who legally challenged this mega sized organisation and so they feel on relatively safe grounds. They have antagonised leaseholders, but how many would be prepared to take on the might of Anchor at an LVT?

This has been very badly handled by Anchor. I also fear for any tenants who do move in. Through no fault of their own they may be shunned or even victimised as they will be seen as the spawn of Anchor’s policy. Everyone is a loser.

Hi Insider, I hear what you are saying but to me it is just playing on words. Ok, they are NOT “changing the lease”, but they are going totally against it and that is not acceptable. If they can ignor the No subletting clause why not just start ignoring all the other points in the lease. Lets forget over 55 or over 65s, lets have any age etc etc, its just goes on and on.

How dare the OFT declare it an “unfair clause” after the way they handled/mishandled the exit fee saga with the usual robbing management companies.

I agree it is not acceptable, but the only way you will force Anchor to change is by public vilification and pressure (via websites such as this) or by action in the courts.

The only other route perhaps is via the housing Ombudsman or the ARHM complaints procedure. However, both have in the past proven to be fairly toothless.

Insider makes excellent points. Had Anchor asked residents whether they wanted to permit sub-letting, and allowed individual sites to make a decision, I doubt that there would have been any trouble.

It is a typical top-down decision of the kind that we are trying to reverse in leasehold. It is wrong and will not endure in a more informed age.

After all, Anchor as freeholder at these sites has a negligible financial stake compared with the combined value of all the leases. Yet it makes all the decisions. They are also freehold owner and managing agent, which is a recipe for high-handedness or much worse.

From Michael Hollands:

If Anchor are able to ignore or change the terms of the lease regarding subletting, then I suggest that the leaseholders consider changing the clauses relating to Exit Fees.

0.9% per annum of the purchase price is ridiculously excessive. I am sure that both the OFT and the Housing Minister would agree

Interestingly, the “deferred service charge” to which you refer ( % of the purchase price paid on the resale of the property which then goes into the reserve or contingency fund for the estate) can be varied by Anchor. The lease allows the landlord the discretion to vary this percentage up or down. Mind you Anchor would probably bungle this as well!

By the way, the deferred service charge is nothing to do with “exit fees” which go into the landlord’s pocket.

Whilst we are on the subject of leases does anyone have any experience of the following situations.

On the BBC programme Homes under the Hammer a 22year old builder purchased a 2 bed apartment in South London for £104000.

This was very cheap for the area and in fact the guide price was only £80000.

Unbeknown to him as he had not read the legal documents there was only 42 years left on the lease. To start with he was unconcerned as he anticipated the cost of an extension to be £5000 to £10000 and he could still make a profit after renovating the apartment.

To his horror the cost was over £40000 and it also meant he could not obtain a mortgage to complete his purchase and also when he came to sell a purchaser would also not obtain one.

This leaves me asking a few questions in relation to Retirement complexes.

1 At what stage is it advisable to get the lease extended.

2 Do companies like Fairhold and Peverel have a set charge for this

irrespective of how long the lease has to run.

3 Can the lease be extended on a single property basis or does the whole

complex have to agree to do this.

4 Do complications occur if not all residents with to proceed, or if some of

the flats are sublet of let out by Girlings.

5 What happens if the lease comes to an end and for some reason it has

never been extended.

Does anyone know all the answers.

Michael,

Also have a look at 2 websites – Leasehold Advice Centre and Leasehold Advisory Service

Michael,

I certainly would not profess to know all the answers and I am not sure whether there is a difference between ‘retirement’ and ‘non retirement’ lease extensions but I can’t see why there should be.

When we purchased our property in 1999 (non retirement) there were 63 years remaining on the lease. At that time we were told that we had to live in the property for 2 years in order to extend the lease and it would be unlikely for anyone to get a mortgage with 50 or less years remaining.We were also told if the lease ran out it would either be renewed or the property reverts back to the freeholder.

It was NOT stressed to us that the cost of extending the lease would increase dramatically as the years ran out. In 2002 a resident in our block apparently paid £2,000 but the going rate now appears to be around £16,000 plus solicitor and surveyor costs of approx £1,100 + VAT.

A general rule appears to be not to allow the years remaining to fall below 80 as the ‘marriage value’ then comes into play and bumps up the price. Not sure how this works but it seems to give freeholders yet another opportunity to fleece leaseholders!!

We are in a catch 22 situation as we cannot afford to extend our lease at present but know if we were to sell it would have to be factored in.

Hope some of this helps and I look forward to hearing more answers myself.

With such a short lease thats probably why it should have sold at somewhere near the guide price!!

As mentioned in my other posts I have one of 18 flats and we own the freehold. When we want to extend our leases it is just a formality with a solicitors fee of approx £500.00 per flat. Hence I do not know too much about leaseholders extending their leases.

Once the lease gets below 80 years (I think) costs will go up year on year. There are example calculations on various websites on the cost to extend a lease. Leasehold Advisory Service is one to look at. Also Anthony Gold Solicitors website is also interesting.

In general I do not think solicitors explain anywhere near enough to leasehold purchasers the implications of what effect their diminishing lease will have – lower sale value, when selling on, would be purchaser unable to obtain mortgage etc.

I am not certain about answers to Michaels questions but hopefully someone will add to this.

I would not like to think large companies like Peverel can refuse outright to extend the lease within current legal terms

Michael,

1. Best to seek a lease extension before the lease remaining term falls below 81 years. Below 80 years, the formula for calculating the compensation to Landlord is increased by 50% of marriage value. You can download the free guides from http://www.lease-advice.org

2.Any leaseholder of 2 years standing can apply for the statutory 90 years lease extension at peppercorn ground rent.

3. Leaseholders of sublet flats can apply for statutory lease extension.

Michael,

Most leases will contain clauses dealing with the end of the lease term and require the flat to be handed back to the Freehold Reversioner. This means the premium paid for the lease by the leaseholder ( property value ) is reduced to NIL.